Protection Money

The Gist: Between the Civil War and the Great Depression, the GOP’s answer to every problem was to RAISE taxes.

The third in a four part series. Find parts one, two, and four here.

Imagine an America where, in response to any economic crisis (or really any excuse), the Republican Party vigorously insists on raising taxes. Furthermore, Republicans contend that this policy is plain old common sense that anyone can see will obviously improve the economy. The only question is what to do with the government revenue - now coming in 50% higher than expenses - and Republicans’ remedy is to expand entitlements as much as possible.

Figure 1. It’s Bizarro world! Up is down! Hello is goodbye! McDonald’s sells filet mignon! The Ritz Carlton is a budget motel! Democrats demand limited government! RINOs are true believers!

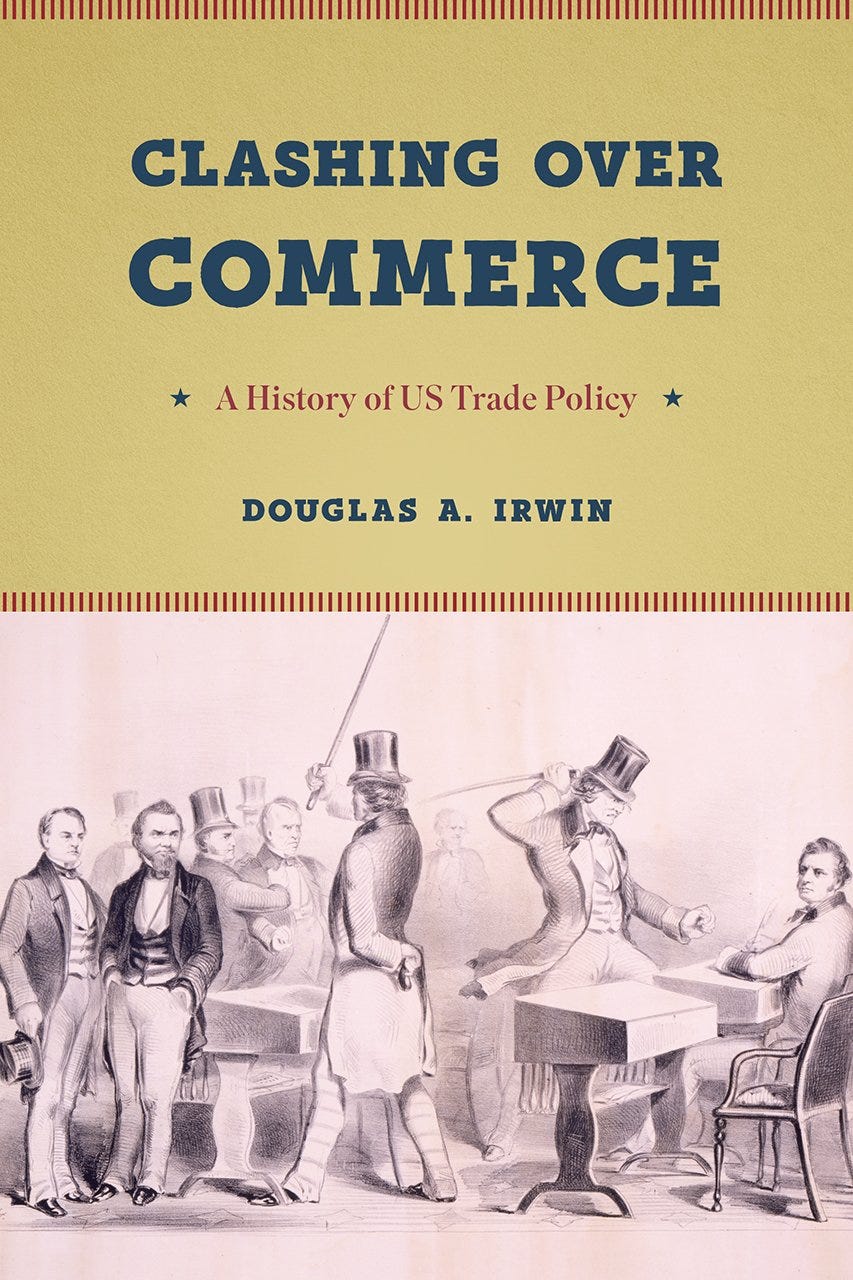

That was the America of the late 19th and early 20th centuries, as described in Clashing Over Commerce, Douglas Irwin’s magisterial history of American trade relations. In part one, we discovered how the Founders were free trade radicals who spent the first decades of the United States trying to manage our complex relationship with Britain. In part two, we witnessed how two Tennesseans navigated steep regional differences to keep tariffs low - only high enough to pay for a limited government. Today, we’ll discuss the period of Republican dominance - and the danger of national consensus on the “obvious” benefits of ultimately questionable public policy.

Where we last left off, the Civil War upended American trade policy. First, the South had an export-oriented economy that led its legislators to fight for free trade - until they exited the government to unsuccessfully fight for secession. Without Southern free-traders, Congress came to be dominated by northerners with significant manufacturing constituents eager for protection. Consistently geographically outnumbered, dedicated to a minority party, when the South returned, its power was much diminished.

Figure 2. When you take your ball and go home, make sure that they don’t keep playing without you - or you may find the rules have changed.

Second, the war between the states was extremely expensive: “The outstanding public debt rose from $65 million in 1860 to nearly $2.7 billion in 1865, about 30 percent of GDP.” The average tariff more than doubled but foreign trade dropped and so, “despite these heavy tax increases, the revenue they raised covered only one-fifth of total federal expenditures during the war; most of the spending was financed by borrowing.” Servicing that debt required high taxes for decades. The average tariff just before the Civil War was under 20% on imports - and the money collected constituted about 90% of federal revenue. Paying for the war prompted tariffs to jump to about 50% while introducing additional, sometimes popular taxes (such as on alcohol). But until the introduction of the income tax in 1913, cash collected from tariffs constituted more than half of government revenue.

Figure 3. Sin taxes have always been popular but if we want to finance all of our present and future defense needs, we could always consider fining bad grammar in text messages. A syntax sin tax, if you will.

Third, the extraordinary spending during the Civil War led, for the first time, to the development of significant lobbying efforts by industry eager for government contracts. When the war ended and spending diminished, lobbyists made themselves useful by advocating for the one big thing the government was prepared to do: protective tariffs. The lobbyist for the American Iron and Steel Association, perhaps the most effective of them all, pithily described their credo: “Protection in this country is only another name for Patriotism.” Industry lobbyists practically bankrolled the Republican Party, took over its machinery, ousted its dissenters, and helped it achieve breath-taking political dominance.

Figure 4. The preferred thesaurus also insisted that lobbying in this country is only another name for enlightening.

A consistent theme of trade politics (perhaps all American politics) is that change required the control of both houses of Congress and the Presidency. Without all three (and the Supreme Court helps, too), the status quo - in this case, high tariffs - continues. Incredibly, between 1860 and 1932, a period of over 70 years, only two Democrats were elected President. During the same period, Republicans controlled the Senate for all but 10 years and the House for over 60% of the time. We will discuss in a moment the two brief periods where free-trade-oriented Democrats were in a position to make change - and how they couldn’t make it last - but it’s easy to see, given the astonishing power the Grand Old Party enjoyed over this time, why high tariffs, the bedrock of their post-war platform, were in place throughout nearly this whole era. And it explains why we are not going to dwell on the personalities of Republicans of this time because they were remarkably similar on the subject of tariffs.

Figure 5. The elephant was the true king of the jungle. If ever we get another seven decades of dominance, here's hoping our platform will be worth it

What’s crucial to understand is that the Republican Party wasn’t simply captured by industry but was advocating a popular platform that they considered common sense: Americans of this vintage genuinely and widely believed that high tariffs contributed to prosperity. We should ask ourselves: were they right? Were they right only for this time period? Were they wrong? If they were wrong, on what major “obvious” public policy issues today might we be wrong?

Figure 6. One possibility.

In the couple of decades following the Civil War, high tariffs were seen as necessary to service the debt - but by the 1880s, the debt was essentially paid off. Yet the country had been so prosperous under high tariffs for so long that people assumed there was a connection. In 1890, tariff champion William McKinley rather reasonably asked: “We lead all nations in agriculture, we lead all nations in mining, and we lead all nations in manufacturing. These are the trophies which we bring after twenty-nine years of a protective tariff. Can any other system furnish such evidences of prosperity?”

If you buy the modern economic endorsement of the benefits of free trade, the United States was gripped by confusion of correlation and causation. Douglas Irwin presents a strong case for this conclusion: The national attitude began to take hold with the final tariff decrease before the Civil War: an 1857 reduction at the peak of the business cycle was followed coincidentally by a financial panic associated with “aggressive financing of western railroads and… land speculation” that led to a recession that gripped the entire economy - and a perception among Republicans that lower tariffs meant trouble. More importantly, in subsequent years, Republicans would pass fresh tariffs in response to business cycle lows - but given the lag between incoming economic data and legislation, “the economy had usually begun recovering from the downturn by the time the higher tariff had taken effect. This pattern created the illusion of a causal relationship: a lower tariff would lead to hard times, and a high tariff would be followed by good times.” And, due to the relatively low percentage of GDP occupied by government spending, adjusting the tariff was practically the only tool the government had to respond to economic downturns.

The biggest opposition to tariffs typically comes from consumers who have to pay more for products - this was certainly the prevailing argument of the South before the Civil War. But throughout this time, the United States dollar was tied to the gold standard and generally deflating, i.e. Americans increasingly got more bang for their buck. Tariff opponents always have a problem selling the diffuse benefits to the general population - but it was practically impossible at a time when Americans genuinely felt goods were cheaper.

Figure 7. Late 19th century Americans were very price sensitive about getting bang for their buck.

These are clever arguments that might help explain attitudes but how do we reconcile the high tariff policies with the prosperity of the Gilded Age? The essence is that America had such awesome endowments that it managed to grow despite its tariff policy.

“In the nineteenth century, the United States had a relatively small and unobtrusive government… The nation had free internal trade and the free movement of labor and capital across states, an abundance of agricultural land and untapped mineral resources, and the enforcement of contracts and protection of property rights through a non-politicized judicial system. The size and scale of the market, knitted together with railroads and other transportation improvements, led to efficient large-scale businesses and innovative organizational structures that encouraged industry specialization and ensured robust domestic competition.The federal government did not interfere with the process of creative destruction and limit competition or artificially prop up inefficient industries. The country had a well-functioning capital market that facilitated high investment rates, access to the world’s best industrial technology from Britain and elsewhere, and an expanding system of high schools that ensured high levels of literacy among the general population. In short, the country was well situated for both extensive and intensive growth, regardless of the trade policy it chose…. “

Furthermore, Irwin points to evidence that industry grew at a continuous, steady rate regardless of tariff policy. Irwin argues that tariffs were designed to protect politically important industries, not economically significant ones, and therefore “‘on balance, it is doubtful if the tariff promoted American industrialization much more rapidly than would have occurred in its absence, and it is even more doubtful that it resulted in any net addition to national income over this period’…. In part, this is because ‘the tariff indiscriminately blanketed protection on many raw materials and manufactures, aiding and abetting those which represented a poor use of resources as well as some in which we were efficient.’” Irwin also interestingly argues that American workers’ relatively high wages were consistent with our land-to-population ratio - and that other countries with dissimilar tariff policies enjoyed the same. Ultimately, Irwin suggests that protection might have invited more immigration, did involve some transfer of wealth (perhaps up to 9% of GDP, mostly from the impoverished South to the growing north), most consumers broke even, and the market remained competitive enough that inefficient businesses were not propped up for too long. Some countries, ours thankfully included, have greater margins for error.

But contemporary Democrats were not generally able to be as persuasive. They weren’t about to make much headway fighting tariffs designed to service the national debt - especially since it was associated with the Civil War in which they had mostly taken the wrong side. But by the 1880s, they were finally able to stir up arguments: the debt was paid, revenue was 50% greater than expenses, and “nearly a third of the nation’s circulating money stock was sitting dormant in the vaults of the Treasury Department.” Was it time for a tax cut? Republicans were aghast. “Democrats… faced rhetorical disadvantages in attacking existing policy. Republicans argued that high tariffs were the foundation of the nation’s industrial prosperity. By contrast, the Democratic position—’a tariff for revenue only’—was hardly an inspiring rallying cry.” When Democrats argued for reducing revenue to get a limited government - Republicans agreed, and said, in a preview of the Laffer Curve, that if tariffs were cut, there’d be more trade and more revenue. Democrats tried some further economic analysis - after all, Adam Smith published the Wealth of Nations way back in 1776. “Republicans rejected the theory of comparative advantage as the ‘refinement of reasoning to cheat common sense’ and accused economists of poisoning the minds of the nation’s youth with ‘academic theories.’” Republicans further blamed the Democrats for succumbing to foreign pressures and of emulating Britain (which, ironically, had shifted from mercantilist policies that prompted our Revolution to a vigorous unilateral free trade regime). Eventually, the Republicans happened upon a solution to the revenue problem: give as much of it away as possible to Union veterans (and their relatives). Like Henry Clay’s American System, this was a brilliant alliance of political constituencies that managed to screw the South. But in giving the money away as fast as they could, in allying with industry lobbyists, the Republicans eventually invited a successful Democrat attack: corruption.

Figure 8. “Eventually, a sober reading of economic literature will prove us right” was difficult to put on signs.

Enter Grover Cleveland in 1884, the (first) president to lose and regain the office. Cleveland is an underrated president who aggressively deployed his veto to curb entitlements and generally fight for limited government. While he deserves credit for going against the grain, he mostly failed. And trade was no exception. During his first term, Republicans controlled the Senate, “the graveyard of tariff reform,” and he was not able to overcome it. When Republicans ousted Cleveland, they were emboldened to pass a new tariff and spend generously, earning the derisive nickname “the Billion Dollar Congress” - little did critics know what budgets lay in store. Cleveland came roaring back in 1892 and the Democrats controlled the House, Senate, and White House for the first time in 35 years. Here, finally, was the opportunity they had waited for! But they first had to deal with a financial crisis. Amidst a badly regulated financial sector, a recession became a depression, with bank runs, double-digit unemployment, industrial slowdowns, violent labor unrest, and increasing fiscal deficits. Cleveland first divided his own party by doubling down on America’s commitment to the gold standard. For their part, Congressional Democrats saw an opportunity to reorient the government’s revenue incentives by passing an income tax but Cleveland accused them of betraying tariff reform, further dividing his party. Despite the acrimony, the Democrats passed an income tax - and a tariff cut from about 50% to under 40% - a disappointment to Cleveland who desired a deeper reduction. Republicans nearly immediately took both houses of Congress back in 1894 - and promptly restored tariffs to above 50%. Meanwhile, the Supreme Court struck down the new income tax as unconstitutional.

Tariff reform seemed dead - but then a significant development occurred: “for the first time in its history, the United States became a net exporter of manufactured goods.” Southerners had always exported raw cotton, and now northern manufacturers were taking advantage of their proximity to natural resources costly to transport (like iron) to produce goods and export the finished products abroad. “European observers dubbed the dramatic change the American Commercial Invasion...The US share of world manufactured exports jumped from 4 percent in 1890 to 11 percent in 1913, reaching 18 percent by 1929.” Our growing export-oriented businesses were concerned that America, now the world’s largest economy, was encouraging trade retaliation by other economies because of our tariff policies. Republican James Blaine, twice Secretary of State, was the initial innovator calling for low-risk reciprocity: “offer tariff reductions on tropical goods that did not compete with domestic producers, in exchange for lower foreign tariffs on manufactured and agricultural goods produced by the United States.” This was very clever, as it managed to simultaneously help industry, hurt no American special interests, blunt Democrat attacks, and increase American influence in Latin America. But this remained a minority position in the Republican Party and only briefly had the opportunity to gain acceptance when President McKinley, the staunch protectionist, gave a speech suggesting some openness to the idea. Unfortunately, he was shot and killed literally the next day. Subsequent Republican presidents acceded to the traditional platform, mostly due to personal indifference, partially due to Congressional deference.

As Blaine attempted to thread the needle within Republican orthodoxy, a new multi-partisan movement arose: Progressivism. Progressives were deeply skeptical of big business and argued that high tariffs increased the cost of living for the working class while “promoting monopolies and increasing industrial concentration.” Ironically, Irwin argues that antitrust law led to industrial concentration: “In 1890, Congress passed the Sherman Antitrust Act prohibiting contracts or combinations in restraint of trade. Three key Supreme Court decisions in the late 1890s ruled that cartels, or horizontal agreements to fix prices, were illegal, but mergers that accomplished the same result were legal.”

Enter Woodrow Wilson in 1912, the second of only two Democrats elected President between 1860 and 1932 - and with him, Democrat control of both houses of Congress for only the second time since 1857. Wilson is deservedly considered by modern conservatives to be a villain of American history, but he was a determined tariff reformer. Originally from the South, he “argued that tariffs were simply a way for politicians to dispense the largess of the government to special interests in exchange for political favors.” For the first time since James Polk, Wilson prioritized and led the tariff reform fight from the White House itself, issuing veto threats to keep even Congressional allies in bounds. For the first time since John Adams, Wilson personally addressed Congress -- to fight for tariff reform. Whereas Cleveland had poisoned the well with backroom accusations against his own party, Wilson used his bully pulpit to successfully encourage Americans to write Congress and demand action. And, in a revealing story about how commercial interests had evolved, Wilson relied on an old successful Democrat tactic of accusing his opponents of corruption - only to discover, in subsequent investigation, that practically no businesses were lobbying to keep protective tariffs. His efforts seem to pay off: he managed to simplify and cut tariffs below 20%, a number not seen since before the Civil War. But we have no idea how this would have impacted the economy because as soon as he succeeded, World War I broke out and imports plummeted. Still, Wilson made two additional gigantic and problematic changes to the American economy that dramatically affected future trade policy: first, he created a Federal Reserve, which introduced another tool for the government in managing the economy. Second, he introduced a durable, constitutional income tax, which replaced the tariff as the primary source of government revenue. While an income tax was in keeping with his broader philosophy, it also reflected his resistance to taking on too much debt. When we entered the war, “federal expenditures soared from $742 million in 1916 to $18.9 billion in 1919” and Wilson refused to borrow the whole amount, instead preferring a new source of revenue. Therefore, “In fiscal year 1913, customs receipts accounted for 45 percent of federal revenue. In fiscal year 1916, this had fallen to 28 percent. After World War I, the share was less than 5 percent.”

Predictably, the Republicans were soon back in power and - what else? - they more than doubled the Wilson tariff to over 40%. In keeping with the broader experience, they managed to pass it just as we were emerging from another recession - and the roaring twenties appeared to again vindicate the policy. Notably, Calvin Coolidge, hailed as a fiscal conservative hero, limited tariff increases by arguing that constant changes were harmful but, inherent to that argument, did not fight his party to lower them. But exuberant over Herbert Hoover’s 1928 landslide, Congressional Republicans strategized how they might push their favorite policy. Importantly, “the tariff revision was offered by politicians rather than demanded by interest groups.” Over 20% of Americans still labored in agriculture and rural representatives felt like manufacturing had gotten too much attention. Resistant to subsidy, Republicans decided to pass new tariffs on agricultural products - even though our farmers really did not face foreign competition. Simultaneously, “once the door was open to changing the tariff for some groups, others—namely, small and medium-sized businesses in manufacturing, even if not suffering from increased foreign competition—were only too happy to take advantage of the situation for themselves.” The problem was that the vote-grabbing was quickly transparent and had little to do with some sort of scientific economic management: “The spectacle of the Senate voting multiple times on tariffs for the same goods, with the outcome shifting depending upon which coalition had the upper hand or which votes were traded among which senators, was widely ridiculed.” Corruption had always been the biggest political weakness of tariffs and it was on full display, as Irwin quotes another economic historian: “Despite a pretense in the debates that there was some objective test of national welfare… the record of voting on individual items furnishes much evidence in support of the cynical proposition that sound protection was that which raised the prices of things produced by one’s constituents, and unsound protection that which raised the prices of things made by someone else's constituents.” As a result, Smoot-Hawley hopelessly complicated trade policy, specifying “rates of duty on almost 3300 enumerated items.” In the middle of their arguments, the stock market crashed and Republicans were spurred to pass their “proven” economic stimulus. Smoot-Hawley raised tariffs to levels not seen since the Abominations that nearly prompted South Carolinian secession: almost 60%.

Figure 9. When you have a hammer, every problem looks like a nail. Though they probably put duties on hammers, too.

Smoot-Hawley would reverse the longstanding American belief that tariffs were the foundation of national prosperity, prompting global retaliation and worsening the Great Depression:

“Between 1929 and 1932, the United States experienced one of the worst peacetime collapses of its trade in history, excluding the embargo of 1808–09. During this period, the value of exports and imports fell nearly 70 percent… In quantity terms, the volume of exports fell 49 percent, and the volume of imports fell 40 percent over those three years. The drop in trade was much greater than the decline in real GDP, which fell 25 percent over that period… Cordell Hull ... used a simple example to illustrate how the Hawley-Smoot tariff backfired against the United States. After the US tariff on imported eggs rose from 8 cents to 10 cents a dozen, Canada followed by raising its tariff on imported eggs from 3 cents to 10 cents a dozen to match the US rate. While US imports of eggs from Canada fell from 13,299 dozen in 1929 to 7,939 dozen in 1932, American exports of eggs to Canada dropped from 919,543 dozen to 13,662 dozen over the same period.

Tariffs were not the cause nor the primary driver of the Great Depression - but Smoot-Hawley definitely hurt and became shorthand for bad trade policy. The impression it wrought became the foundation upon which the third era of American trade was built on: negotiating reciprocity.

Figure 10. Click here to acquire Clashing over Commerce 10/10 - a magisterial retelling of American history through the important lens of trade, filled with insight into the events that defined the country over its three eras of tariffs: for revenue only (through Civil War), for protection (through World War II), and for reciprocity (through today). Two interesting aspects of American trade policy of the protection era I’ll mention here at the end: First, Irwin argues that America’s high tariffs on sugar crashed the Cuban economy, inspired a domestic rebellion against Spanish rule, and eventually invited the Spanish-American War. The same tariffs exempted then-independent Hawaii and eventually prompted American annexation of the weak, close trading partner. Second, Irwin addresses the notion that modern developing economies should consider a high tariff regime to mimic early American growth: “Many developing countries today have large, intrusive, and often corrupt governments, relatively small domestic markets, and create barriers to foreign investment and technology transfer. These differences mean that the US experience has few policy lessons for developing countries today.” For a counter-argument, see Joe Studwell’s How Asia Works, which argues that countries like Japan, South Korea, and Taiwan became successful through trade protection, partially inspired by the American experience, and got around the typical problems associated with tariffs by subsidizing only those products that American consumers bought in our free market.

Thanks for reading! If you’ve enjoyed this email, forward it to a friend: know anyone who fervently believes in the common sense of modern, questionable policies? How about someone who appreciates American history? Or anyone who has ever purchased anything produced overseas?